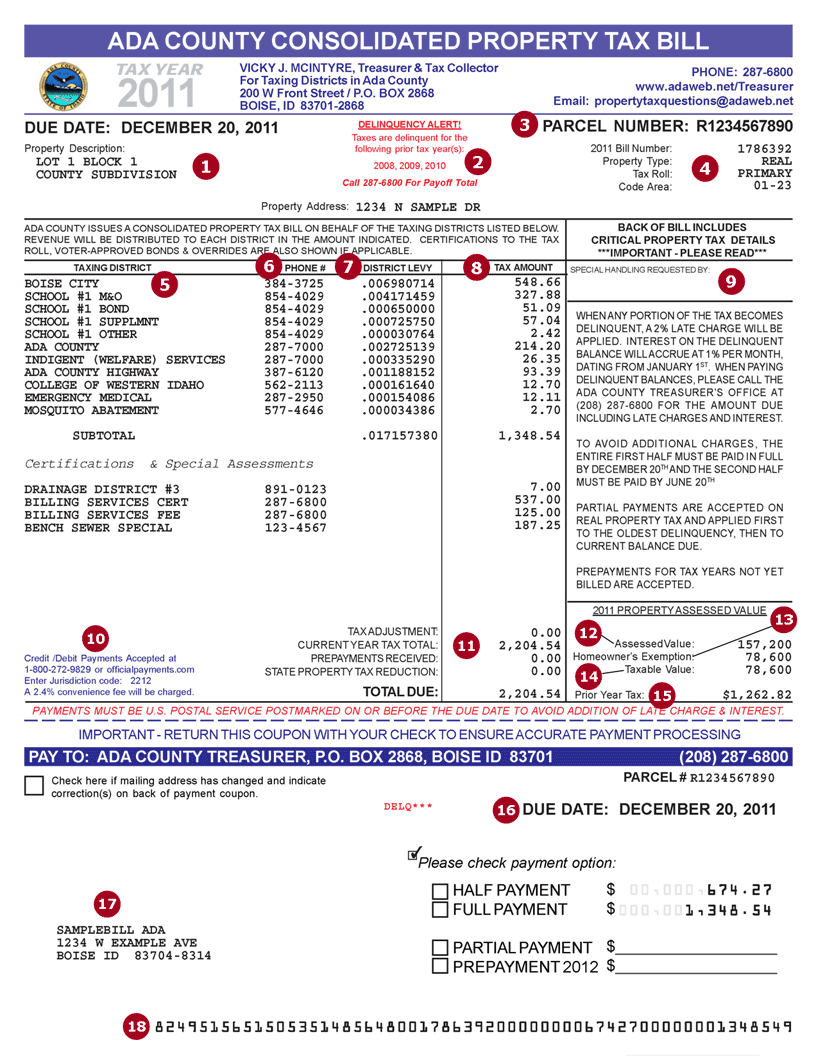

Property Tax Bill Breakdown

This tax bill breakdown is provided to assist you with understanding all of the information and various sections on your Ada County Consolidated Property Tax Bill. Please click on the number below for any item you wish to learn more about, and you will be taken to the corresponding explanation of that item at the bottom of this page.

Property Description: (REAL, PERSONAL or MFG HOUSING)

- If the Property Type is “REAL” (see #4) this field will include the Lot, Block and Subdivision wherein the property lies, or if the property is not in a subdivision, it will show the Township, Range and Section where the property is located. This is not intended to be a full “legal description” of the property

- If the Property Type is “PERSONAL” (see #4), this field will indicate that the taxes billed are for “Business Personal Property” or furniture, fixtures and/or equipment used in doing business. The Property Declaration filed by the business each year includes the full listing of property assessed.

- If the Property Type is “MFG HOUSING” (see #4), this field will include the make, model and year of the manufactured home. It may also include a full or partial VIN number and/or title number and dimensions of the home.

If you have past due taxes owing, the delinquent tax year(s) will be noted in this field and you will need to contact the Treasurer’s Office for a payoff figure. If this field is BLANK, that means that all prior year taxes billed under this parcel number have been paid in full.

Real property parcel numbers usually begin with either the letter “R” or “S” followed by a ten-digit number indicating taxable land and improvements under common ownership on residential or section property.

Taxable leasehold improvements on State or Federal lands will have a parcel number starting with “O” followed by ten digits. The letter “O” is also used to designate taxable real property improvements on land owned by a separate party (i.e. Retirement/Assisted-living communities).

Manufactured home parcels begin with the letter “M” followed by the first four letters of the make of the home, and the last two digits of the year the home was manufactured. Four additional digits complete the unique parcel number for each home. (Example: MFLEE991234 would be a 1999 Fleetwood manufactured home)

Business personal property parcel numbers begin with the letter “P” followed by a “1or 2” if the furniture, fixtures & equipment are owned by the business, a “7” for leased furniture or equipment or “5” for migratory property (located in Ada County for only part of the year).

Public Utilities and Railroad Operating property are centrally assessed by the State of Idaho and have parcel numbers beginning with “8” or “9” followed by ten digits.

Dry grazing properties located in the special Meridian Rural Fire District begin with a “!” followed by ten digits.

- “REAL” – Land and attached Improvements

- “PERSONAL” – Furniture, Fixtures & Equipment used in business

- “MFG HOUSING” – A manufactured home that is not on a permanent foundation and has not been declared as real property. Manufactured homes are titled by the State of Idaho in a manner similar to that of motor vehicle titling.

- “MFG/LAND” – Land and Improvements together with a manufactured home under common ownership and occupancy. The billing of the manufactured home and land taxes are combined under a single parcel number to facilitate billing and to allow the property owner to receive the full benefit of the Homeowner’s Exemption.

TAX ROLL:

e. “PRIMARY” Tax Roll – Property assessed between January 1st and June 1st. The Primary Tax Roll is billed by the 4th Monday in November each year.

f. “SUBSEQUENT” – Property assessed after a closure of the Primary Roll through October 31st. Bills for the Subsequent Tax Roll are mailed by January 20th of the year following assessment and are due by February 20th.

g. “MISSED PROPERTY” – Property assessed November 1st through December 31st of the tax year. Bills for the Missed Property Tax Roll are mailed by February 20th and due by March 20th.

CODE AREA: The “Code Area” is a number that represents the group of taxing districts receiving revenue from your property taxes. The itemized listing appears in the center of your bill.

This is the list of Taxing Districts who will receive revenue from your property tax payment. The levied taxing districts are listed first, followed by Special Assessments and Certifications to the property tax roll.

“INDIGENT (WELFARE) SERVICES”: The Indigent Services Department exists to carry out the mandates and intent of Idaho law contained in Idaho Code; Title 31, Chapters 34 & 35 providing limited and temporary assistance to Ada County residents including payment of medical (and certain non-medical) expenses. Assistance rendered should be “as a last resort” only; or when no alternative exists. All counties in Idaho, including Ada County, will require repayment of any taxpayer funds used to assist a county resident under these laws. With the recent economic crisis the resources of the County’s Indigent Services fund have been stretched to the limit with claims expected to increase again in the next fiscal year. This sub-levy of Ada County has been separated out of the Ada County total levy for 2011 to clearly identify the increased budged required to support this mandate.

CERTIFICATIONS & SPECIAL ASSESSMENTS: Certifications to the tax roll and Special Assessments are listed below the Taxing Districts and may include the following: Drainage District, City or Highway Local Improvement Districts, Sewer District, Weed/Pest control, Recovery of a prior year Homeowner’s Exemption improperly claimed or granted, Unpaid/delinquent Personal Property Taxes, etc.

For each Taxing District or Certifying Agency are listed in this field. If you have questions about how your tax dollars are utilized in a specific District, please call the number listed. For general property tax billing questions, call the Ada County Treasurer’s Office at (208) 287-6800, or e-mail questions to taxinfo@adacounty.id.gov.

Officials for each taxing district determine the annual budget needed to provide the district’s services. The part of the approved budget to be funded by property tax is divided by the total taxable value of all properties within the district. The result is the district’s tax rate or “levy”. (Property Tax Supported Budget ¸Taxable Value of Property in the District = Levy). When you multiply the levy by the taxable value of your property, you see the tax amount that will be collected by that district from your property taxes.

The Tax Amount each Taxing District will receive is itemized in this column and is calculated by multiplying the Taxable Value of your property by the District Levy. The total of all levied taxes is subtotaled. Amounts due for Certifications and Special Assessments are itemized below the levied amounts and are also subtotaled.

If property taxes are included in your monthly mortgage payments, the lender will usually request an electronic bill directly from our office. When a lender indicates that they intend to pay your bill, we send you a “Copy Bill” advising that the original bill has been sent to the named mortgage holder. It is important that you confirm that the name in this field is that of your most current mortgage company—the one currently holding funds for payment of property taxes. If your mortgage has recently changed, you may need to forward a copy of the bill to the new lender to make sure it is paid timely. If the field is blank, no lender has requested the bill and you have the original. If you have paid off or refinanced your mortgage and no longer have a tax impound account, you can pay using the copy bill. Please return the tear-of stub at the bottom of the bill with your payment. The coding number at the bottom of the stub will ensure that the payment is properly applied.

Internet & Phone Credit Card Payments Options are in place and ready to go. Credit Card payments can be made on the Internet, over the phone or over the counter. To pay by Credit Card on the Internet, the customer will need to access the website at adacounty.id.gov

For payments by phone, dial: 1-844-471-7324

MERCHANT FEES FOR CREDIT CARD PAYMENTS

Powered by: 2.4% or a Minimum of $2.00

This is not an Ada County Treasurer charge; the fees are paid directly to the Point & Pay Merchant for processing Credit Card payments.

The taxpayer pays all fees associated with a credit card transaction. Credit Card payments will not be accepted as current after 5:00 P.M Mountain Standard Time on 12/20 or 06/20.

Please make sure any callers inquiring are aware that if their payment is not completed by 5:00 P.M only a US postmark will prevent the addition of the late charge and interest.

The customer should receive a confirmation code once the transaction has been completed.

Point & Pay, a private vendor, provides credit card payment services and the taxpayer is responsible for all fees associated with the transaction. The fee is 2.4% and will appear as a separate line item on the credit card bill. The fee is paid to Point & Pay on behalf of the credit card company and Ada County does not receive any portion of the fee.

This field reflects tax adjustments approved by the Board of Ada County Commissioners after the assessment roll was finalized, and reduces the total amount of taxes billed.

Total Taxes Billed: This is the total billed amount. It includes the subtotal of levied taxes, certifications, and special assessments, minus (-) any Board approved adjustments and/or cancellations.

Prepayments Received: Prepayments received early may not be reflected on the 2011 Primary Roll bill. Prepayments are applied to the first half taxes first, then to the second half.

Tax Reduction (Circuit Breaker): If you applied for the Idaho State Circuit Breaker program and met the requirements to receive property tax relief, a tax reduction amount will appear in this field. If the Circuit Breaker reduction pays your bill in full, there is no need to return anything to us. The notice is just for your information and records. Please do remember that since the Circuit Breaker is an income-based program, you must re-apply every year by April 15th. For more information about the Circuit Breaker, visit the Idaho State Tax Commission website at http://tax.idaho.gov/i-1052.cfm

This is the TOTAL assessed value of your tax parcel for the current year (shown at the top of the bill next to the County seal).

The Homeowner’s Exemption is equal to 50% of the value of your owner-occupied home and up to one acre of land, to a set maximum amount that varies from year to year. The maximum exemption is tied to Federal Housing Finance Agency Housing Price Index, rising and falling according to index averages. To see current year exemption maximum and history of Homeowner’s Exemption trends, go to Idaho State Tax Commission.

This is the value used to calculate your property taxes. Assessed Value minus (-) Homeowner’s Exemption equals (=) Taxable Value.

This figure represents the total levied property taxes from the prior tax year. It does not include certifications to the tax roll, fees or special assessments billed in the prior year.

The date in this field is the statutory property tax due date. To be considered current, payments must be in our office by 5:00 p.m. on the due date or carry a US Postal Service postmark dated on or before the due date. If the payment does not meet the above criteria, late charges and interest will apply. Please note – A postage meter stamp does not qualify as a U S Postal Service Postmark.

If the mailing address shown on the bill has changed or is incorrect, please check the box on the front of the payment stub and provide the correct address on the back of the stub. Our automated system will capture the address change so the system can be updated.

This long string of numbers contains the information required by our automated system to ensure that your payment is properly applied to your parcel. Please return the tear-off stub with your payment.